As your SaaS company expands, so does the need to tap into new sales markets, hire more employees, use more sales channels, and register new products and services that may require you to file additional taxes.

The sales taxes your accounting and finance teams manage will also increase—and as much as your team exercises due diligence in processing and reporting data for compliance, there would still be costly loopholes in the system that you have to address.

Here’s why automating your tax management is something you should prioritize to focus on other integral aspects of your business.

Benefits of Automating Your Sales Tax Compliance

- It saves you time and money.

In the words of tax solutions software company Avalara, the goal is to “expand your business, not your tax department.” Tax automation software not only streamlines your tax compliance processes but also allows you to make the most out of your existing tools and technologies for other programs, such as your eCommerce platforms and security, among others. Automation also gives your teams the ability to efficiently handle multiple transactions simultaneously and consolidate hundreds or thousands of items within a single system.

- It allows for more accurate data processing and reporting.

Businesses still using manual spreadsheets in sales tax compliance run the risk of having a database that’s ridden with errors and inconsistencies. As tax regulations vary per state (or per country if you’re in the international market), it can be challenging to keep track of every detail and meet the deadlines set for filing returns.

Letting go of this practice for good and leveraging a tax operations software ensures that you are correcting computing tax rates, that everything gets filed on time, and all data reported are error-free and reliable.

- It reduces unnecessary risk.

Audits are inevitable in any business, and it’s something that leaders should prepare and be in compliance with. Failing to pay for your liabilities and file use tax returns correctly and on time can flag you for a thorough audit and incur additional costs if violations or irreconcilable details are spotted. You can’t prevent audits; however, paying fines resulting from non-compliance can be avoided through automation.

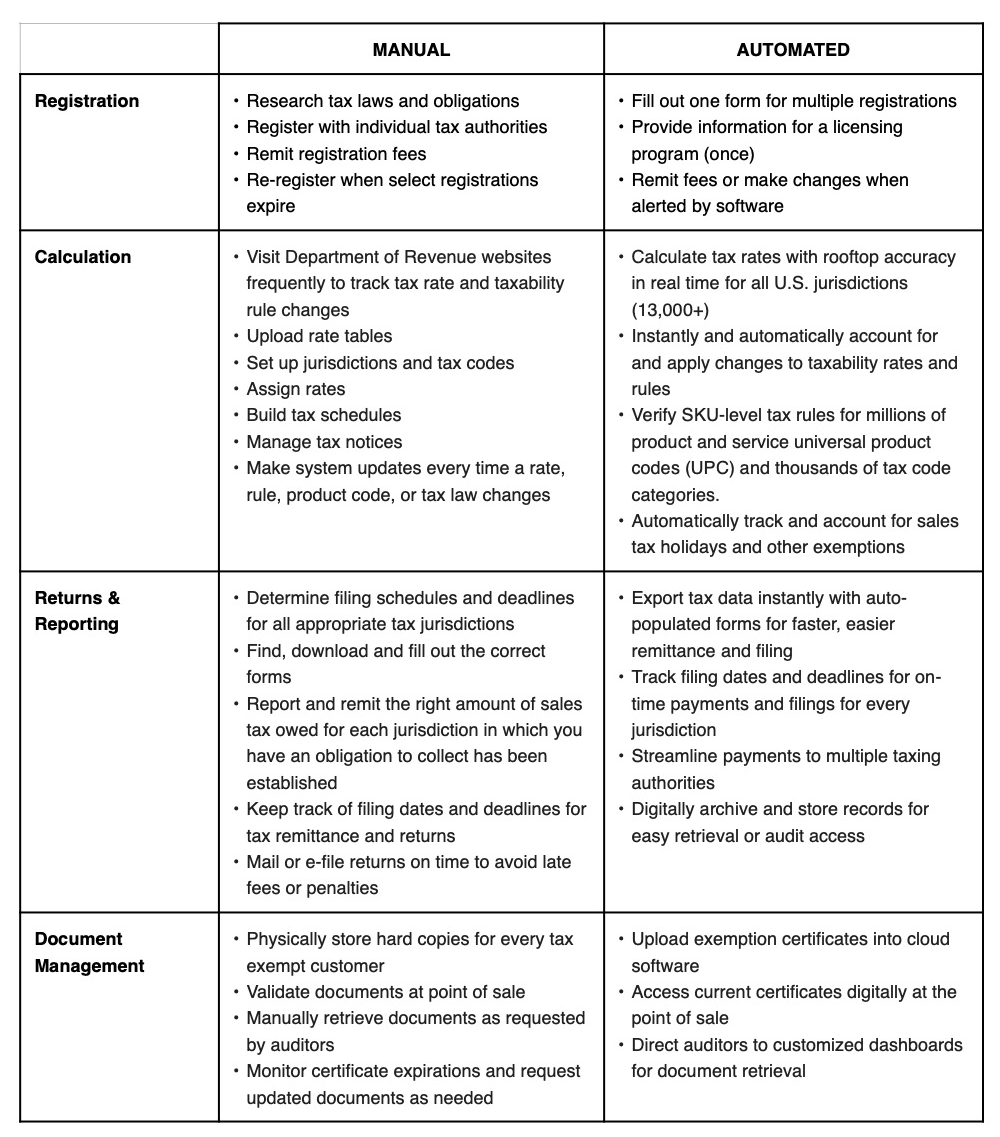

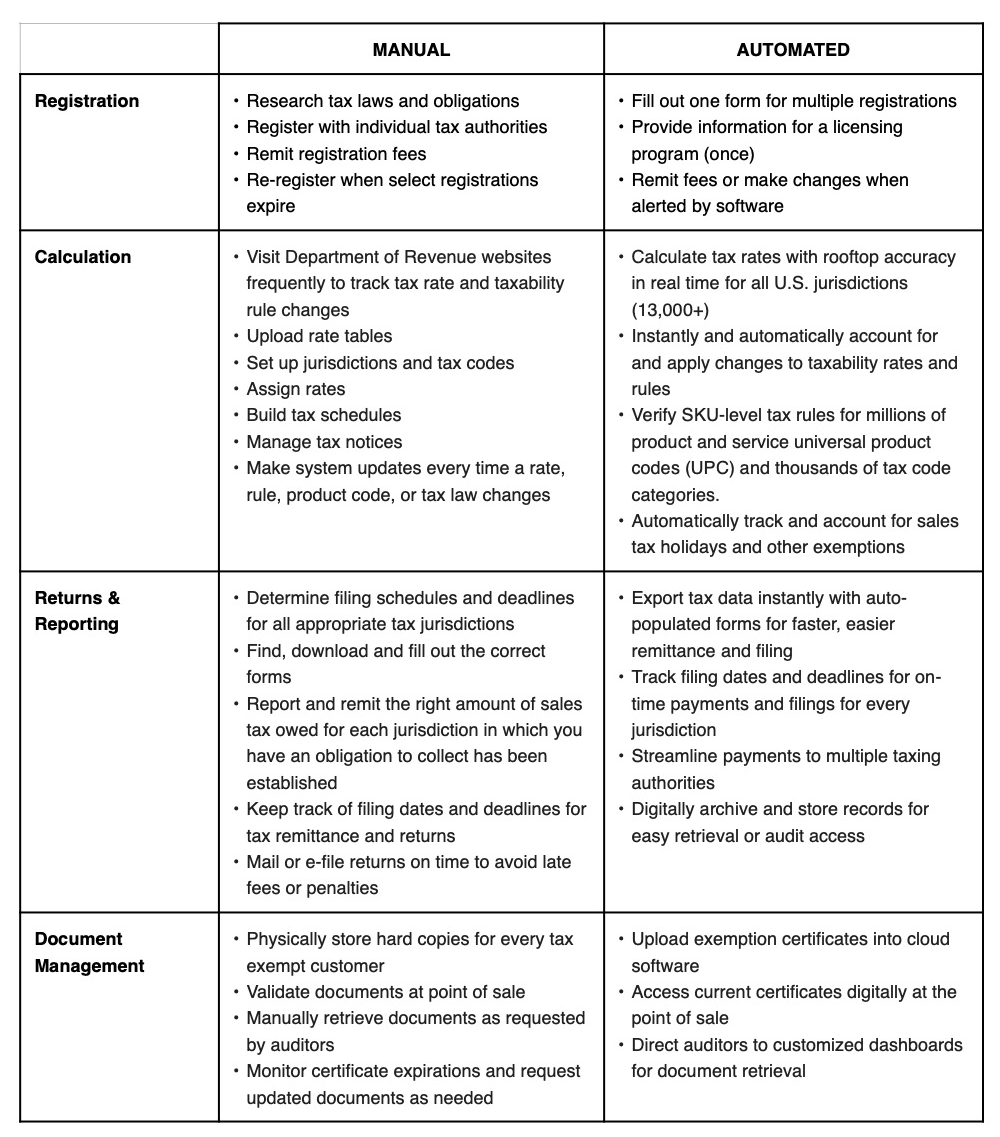

Manual vs. Automated

Below is a side-by-side comparison made by Avalara between a manual and automated tax compliance process.

Source: Avalara

Tax Compliance Automation for Growth

Compliance is critical in keeping your business safe and afloat, but if you’re still doing everything manually, it could cost you many resources in the long run and even compromise the integrity of your company. Using tax automation software makes the entire process simpler and more efficient and ensures that you are on the right track as you gear up for future growth.

Our webinar on tax compliance for SaaS and software companies starts at 2:00 PM EST. Join here.

Photo by Kelly Sikkema via Unsplash